Edwin Leow and Shaun Zheng of Nexia TS Tax Services assess the new criteria for family offices introduced by the MAS in Singapore

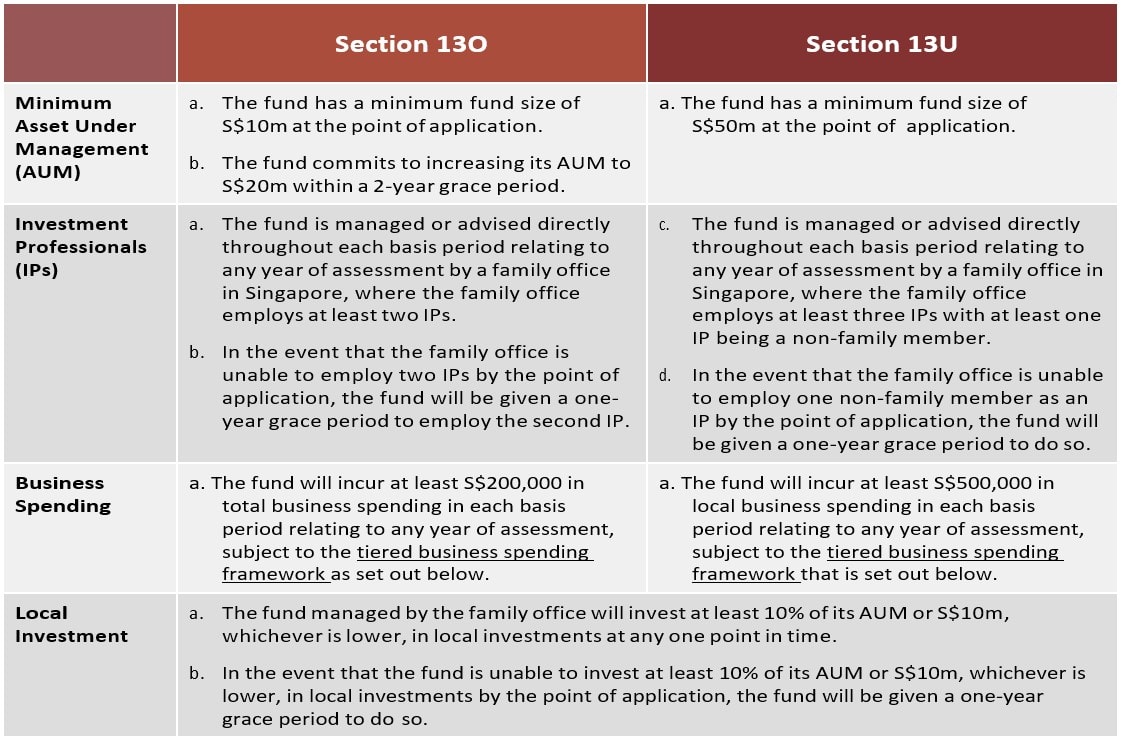

The Monetary Authority of Singapore (MAS) recently announced new stricter criteria for family offices to receive tax incentives in Singapore. The new rules came into effect on 18 April 2022, whereby funds that are managed and/ or advised directly by a family office which is:

- An exempt fund management company which manages assets for or on behalf of the family(ies); and

- Is wholly owned or controlled by members of the same family(ies),

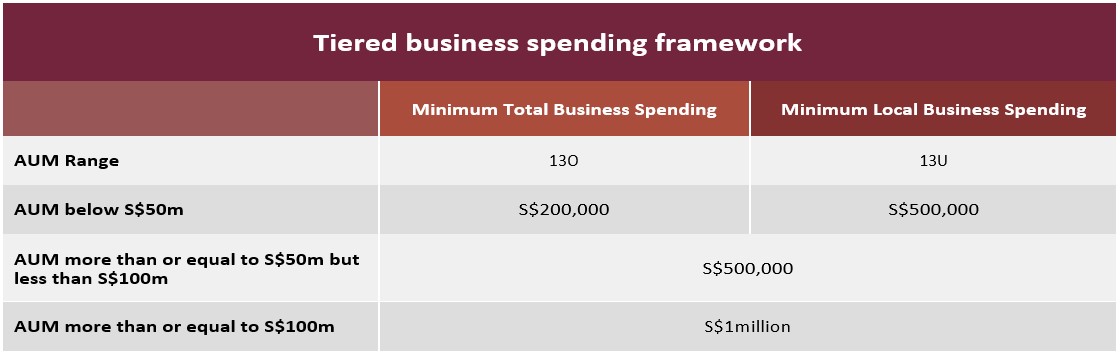

must meet the updated conditions, applicable to Section 13O and Section 13U of the Income Tax Act of 1947, and are set out below:

Before the introduction of these new conditions, there was no requirement for a Resident Fund to have a minimum AUM and minimum number of investment professionals. Further, there was no requirement for both the Resident Fund and Enhanced-Tier Fund to invest in local investments previously.

Although these appear to be an additional set of stringent requirements being introduced, it is not inconceivable as Singapore continues to see more family offices being set up. With the city-state now firmly rooted as the leading destination of choice for family offices, the Government can afford to further refine conditions to help meet other broader policy objectives.

For example, the measures on minimum business spend and hiring will help stimulate the local economy, create new jobs and further raise professionalism in the asset management industry. Also, to continue defending its position as the country of choice, the local investment requirement will help to further shine a light and/ or serve as indicator as to whether the family offices are committed to invest in Singapore talent and local investments, coupled with the inimum AUM requirement, which should serve as an effective filter to exclude those families who do not wish to or do not want to grow their AUM, and are using Singapore as a safe harbour for a portion of family wealth.

It is expected that family offices will soon acclimatise to these additional requirements even if there is still intense competition among regional financial centres for investor dollars. Singapore’s political stability, economic progress and first-in-class healthcare facilities and education system, among others, should continue to triumph and be at the top of mind as these HNW individuals go about planning and safeguarding their private wealth and legacy.

Edwin Leow

Director, Head of Tax

Nexia TS Tax Services Pte. Ltd.

Shaun Zheng

Director, Private Wealth and Asset Management Tax Lead

Nexia TS Tax Services Pte. Ltd.