When the word “trust” is mentioned, it is likely that this term will go over the heads of majority of Singaporeans. That’s because of the common perception that it is a subject reserved for discussion among only the ultra-high net worth community. In this piece, we will attempt to provide a clearer understanding of what a trust is, and debunk the misconceptions that are stopping individuals from setting up a trust in Singapore and taking full advantage of its benefits as an estate planning instrument. Depending on the objectives of an individual, some trusts have a more complex structure, but the bulk of most are used in very direct and practical ways.

WHAT IS A TRUST?

Imagine you’re holding on to a bowl of candy. Before leaving the house for a weeklong work trip, you hand this bowl over to your spouse together with a set of instructions on how you want your candy to be distributed to your children. If you are concerned that your children aren’t disciplined enough to ration the candy on their own (and worry they may gobble up everything at once), your instructions to your spouse could include giving them one candy each after mealtime for the entire week.

Similarly, the archetypal trust is a legal arrangement by which you, the owner (“settlor”) of the assets, create the trust and appoint another party whom you trust (“trustee”) to manage your assets according to your instructions (“trust deed”) for the benefit of the loved ones (“beneficiaries”) you have listed down in the trust deed.

So figuratively, the bowl of candy is like a trust.

THE 6 MISCONCEPTIONS

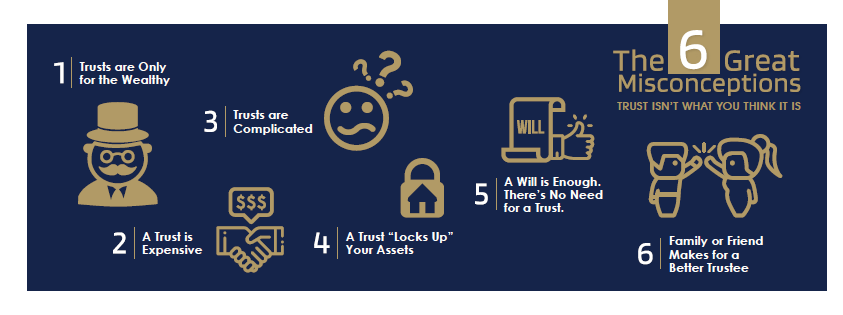

Before you decide to bury the idea of trusts as a potential solution for your estate planning, here is a list of common misconceptions that many people have about trusts which may encourage you to reconsider setting one up for yourself. You’re not alone if you find yourself falling into one or more of these categories.

Misconception #1: Trusts are Only for the Wealthy

This is perhaps the most common assumption about trusts. While it is true that many wealthy people set up trusts, many in the middle-income group make full use of the benefits of a trust for a variety of purposes in their estate planning. In general, a trust is set up to ensure the estate does not become misappropriated.

Misconception #2: A Trust is Expensive

While there are set-up fees payable, a trust need not be actively administered or managed by the trustee. For example, with a standby trust, one only needs to pay a one-time set-up fee upon creation. Thereafter, there are no on-going trust administration fees until the standby trust is activated, usually upon the occurrence of a triggering event, e.g. death or mental incapacity of the settlor, when assets are transferred into the trust.

Misconception #3: Trusts are Complicated

Usually, setting up a trust in Singapore is not as confusing as it seems. Depending on your estate planning goals, you can set up a trust that is as simple or as complicated as you want it to be. All you need is to list down your objectives – whether it is for protection of assets, provision of funds or anything else – and exactly how you would want the trust to work for you.

Have a chat with your estate planner so that he/she may take you through the process for easier understanding. The last thing you would want to have is a trust that doesn’t serve its purpose.

Misconception #4: A Trust “Locks Up” Your Assets

Again, it depends on what your requirements are for setting up a trust. As stated above, with a standby trust, you need not settle any assets into the trust until a triggering event (such as death) has occurred. Meaning during your lifetime, you retain control over your assets.

If you wish to set up a trust in Singapore and immediately settle assets into the trust, you may retain the power to revoke the trust (revocable trust) which allows you to withdraw your assets if you change your mind.

Misconception #5: A Will is Enough. There’s No Need for a Trust.

A will is required to undergo the process of probate, which grants the executor authority to deal with the deceased’s estate. Without the probate, the executor cannot execute what is written in the will. Also, wills can be challenged and may cause unnecessary delays in the execution of your wishes. In addition, your will will become a public document once it has gone through the probate process.

A living trust does not need to go through the process of probate, so the release of the trust assets to the beneficiaries will be made within a shorter period, in exactly the way you want it to. arguments over assets can be avoided as well because whatever has been instructed by the settlor will be done. Furthermore, should one set up a trust, there is strict confidentiality among the beneficiaries.

Misconception #6: Family or Friend Makes for a Better Trustee

Understandably, people would choose to appoint a close family member or friend as their trustee. After all, who else would make a better choice, right? Unfortunately, many fail to understand the huge amount of work and responsibility they will take on should they agree to act as a trustee. In addition to creating potential tensions within the family, there are also legal implications if the trustee’s role is not fulfilled properly.

A suitable alternative would be to appoint a trust company. This solution shifts the workload entirely to a neutral party who has the expertise and capability to manage the settlor’s estate. Any disagreements regarding the distribution of assets will then be significantly reduced.

WHAT WE SAY

It is important to evaluate your list of assets, decide what your goals are and how you want them to be managed after passing on. After which, a chat with an estate planner would be in order, to help you understand the processes and provide you with the right support before setting up a trust for yourself.

Disclaimer: Any information in this feature is intended to provide only a general understanding of trusts. It should not be misconstrued as material to be used for advice of any kind especially with regards to financial, legal, or tax-related practices. Should you need further advice relating to your estate planning, do approach our consultants to discuss how to structure your trusts according to your requirements.

This article is first published on our newsletter, The Custodian Issue 12 on September, 2019. Click here to subscribe to our latest newsletter.