Ooi Sen Tee

AEPP®

Relationship Manager Precepts Trustee Ltd (PTL)/

Estate Planning Practitioners Limited (EPPL)

Since the launch of ProviTrust, we are heartened to receive an influx of queries from practitioners managing customers’ enquiries. We have compiled a list of commonly asked questions in this first series which will help you to understand the ProviTrust process.

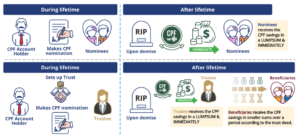

Q: Why do I need a trust when I can make a CPF nomination for my CPF savings?

A: The CPF nomination specifies the persons who will receive your CPF savings and how much each nominee would receive upon your demise.

A trust expands the options, to further address other concerns, such as deferring and staggering the pay-outto the nominees should you deem them financially immature or vulnerable because of young or elder age.

Q: Do I still need to make my CPF nomination after I set up ProviTrust?

A: Yes, you will need to make your CPF nomination to your appointed trustee of the ProviTrust. Without making a nomination, the trustee will not be able to receive your CPF savings upon your demise to carry out the duty as trustee according to your instructions in the trust deed.

Q: What is the difference between a nominee and a trustee?

A: A CPF nominee is any person or organization whom you appoint to receive a share of your CPF savings.

A trustee in general acts as the legal owner of the trust assets (the CPF savings) and is responsible for the handling and distribution of the assets in the trust, according to the trust deed, for the named beneficiaries.

Q: Can I transfer other assets into ProviTrust and activate it during my lifetime, since this is a living trust?

A: ProviTrust is designed specifically for your CPF savings. This is a digital trust where the set-up process is via a portal using your SingPass login. The process will be completed after the CPF nomination (through the CPF Board portal) is made by naming the trustee as the nominee.

Q: How do I decide whether I should set up a fixed trust or discretionary trust?

A: A fixed trust is set up with your instructions where your appointed trustee must strictly follow them as stipulated in the trust deed and he has no power to alter them.

You may use the following guide as reference to set up a fixed trust:

-

When you only have one group of beneficiaries, and you do not anticipate any issues that may arise with them receiving the specified fixed shares.

-

The tenure of the trust period is relatively short, and you do not foresee any drastic or frequent changes, to your beneficiaries’ circumstances during the trust period.

-

When you have determined the distribution manner and you do not foresee any need to change the instructions during your lifetime.

-

When you wish for your trustee to follow strictly on the allocation, and the trustee is not have any power to alter it.

With a discretionary trust, you may name beneficiaries and specify the desired allocation that you wish to give to them. But the trustee can exercise his/ her discretion to alter the wishes, validated with supporting rationale, and exercised in the best interest of the beneficiaries, in situations where their circumstances may have changed.

You may decide to set up discretionary trust using the following guide as reference:

-

When you like to prioritize your beneficiaries to benefit from your CPF savings. There are two groups of beneficiaries for a discretionary trust. The main group will be prioritized to receive your CPF savings, and a substitute group will be the secondary beneficiaries to receive in the event of the main group’s demise.

-

You have beneficiaries who may be exposed to risk of bankruptcy or may experience dysfunctional marriages.

-

You would like to give the flexibility to your trustee, to provide for your beneficiaries with your CPF savings, when genuine needs arise.

Q: Will my trustee know how much I have in my CPF account during my lifetime?

A: No, the trustee will not know your CPF account details, during your lifetime. The trustee is only aware of the trust details, such as the beneficiaries and the distribution manner to each beneficiary, that is recorded in the trust deed.

Q: If I nominate a trustee in my CPF nomination without informing him or her, will he or she be notified?

A: No, your trustee will not be notified by CPF board when you have changed or nominated him or her as trustee.

However, since this is a trust arrangement and you are appointing your trustee to act according to your instructions, it is a good gesture to keep your trustee informed and updated of any changes that you have made, on your CPF savings distribution plan.

Q: Can I appoint more than one trustee with ProviTrust?

A: With ProviTrust, only one trustee appointment is allowed, which could be an individual or Precepts Trustee.

This is because ProviTrust is designed to receive CPF savings as trust asset through the CPF nomination. After the trust is set up, you must nominate the appointed trustee in your CPF nomination. CPF nomination doesn’t allow substitute nominee, hence no substitute trustee.

Q: Can I change the trustee after I have set up ProviTrust?

A: Yes. There are two important steps to note when you change your trustee for your ProviTrust. Firstly, it is to send your request via email to info@epplasia.com or contact your Estate and Succession Practitioner. There will be a supplementary deed issued, to remove the existing trustee and appoint a new trustee, and a fee will be incurred.

Secondly, you need to change your nomination with CPF Board, by nominating the new trustee. This is to ensure that your CPF savings will be paid to the new trustee upon your demise. CPF Board will transfer your CPF savings according to the latest nomination made. You may want to inform your beneficiaries too.