By Mr Lee Chiwi

Excerpt from PreceptsGroup Succession and Trusts in Wealth Management (4th edition) Book

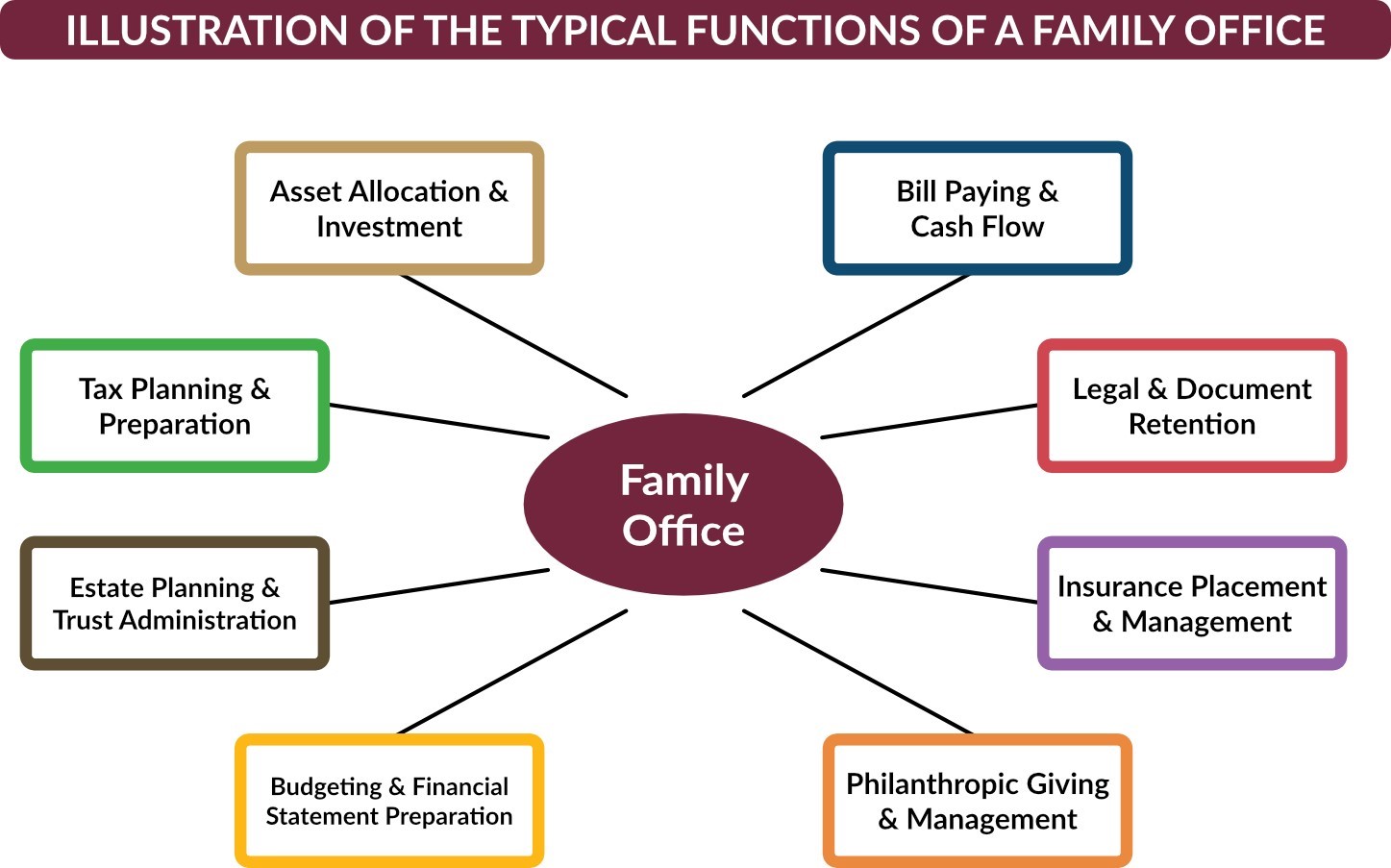

Some of the high-net-worth individuals (HNWI) may have the resources and need to set up what is termed as a “Family Office” to manage the substantial wealth and private matters of their family. The Family Office model is largely borrowed from the United States where the origins of the modern family office had likely emerged from. It is essentially a structure that engages in the management and succession of say a family’s diversified wealth like a corporation. Like other corporations, the Family Office employs permanent staff and professionals to undertake various functions relating to investments, asset management, legal affairs, trusteeship, risk management, and tax. Professionals that are engaged include asset managers and investment advisers, trustees, in-house counsel, tax advisers, and accountants. Family members may be appointed as board members alongside external persons with expertise that the family may lack among themselves.

A tenet of the Family Office is the objective of educating the family members, especially the younger members on the values, objectives, investments, and financials concerning wealth management and their grooming to take leadership positions in the future as part of the ongoing succession and generational planning for the family.