Researched and written by ERA Research & Consultancy Department for publication in The Custodian Issue 21

- As the Singapore economy gradually recovered amid the Covid-19 pandemic, the residential real estate market rebounded strongly in 2021.

- Private residential property prices increased by 10.6% year-on-year in full-year 2021.

- This price expansion was led by the capital values of landed residential properties.

Landed housing prices gained pace in 2021

Landed residential properties are among the most expensive housing in Singapore. Prices can range from $1.5 million for an older terrace house to tens of millions of dollars for a Good Class Bungalow. In 2021, landed residential property prices in Singapore appreciated at the fastest pace in the past 10 years. They surged by 13.3% year-on-year in 2021, compared to a lackluster 1.2% expansion in 2020.

When the Covid-19 pandemic slowed the Singapore economy in 2020, capital values of landed housing — like other real estate values in Singapore — were adversely affected and resulted in a much slower annual growth rate that year. However, real estate market sentiment started to improve from the second half of 2020 onwards. It received a further shot in the arm when the Covid-19 vaccination programme was implemented in 2021. This contributed to the subsequent faster rate of property price growth.

Interestingly, the capital values of landed housing increased at a faster pace in the first two years of the pandemic compared to the two years before Covid-19 became a household word in early 2020. Landed residential property prices increased at an average annual rate of 6% in 2018 and 2019. However, prices expanded 7.1% annually on average in 2020 and 2021.

Prices of landed housing also grew faster than prices of non-landed properties, such as condominium units, from 2018 to 2021. During this four-year period, capital values of landed residential properties increased by 28.8%, while capital values of non-landed housing grew by 24.2%.

Table 1: Residential property price growth

| Year | Annual growth of landed housing price index | Annual growth of non-landed housing price index |

|---|---|---|

| 2018 | 6.3% | 8.3% |

| 2019 | 5.7% | 1.9% |

| 2020 | 1.2% | 2.5% |

| 2021 | 13.3% | 9.8% |

Source: URA, ERA Research & Consultancy

More landed homes sold in 2021

The Covid-19 pandemic prompted more white-collar workers across the globe to work from home. This sparked a demand for more space at home, and the growing wealth and income of the upper-middle class led to more demand for bigger condominium units and houses.

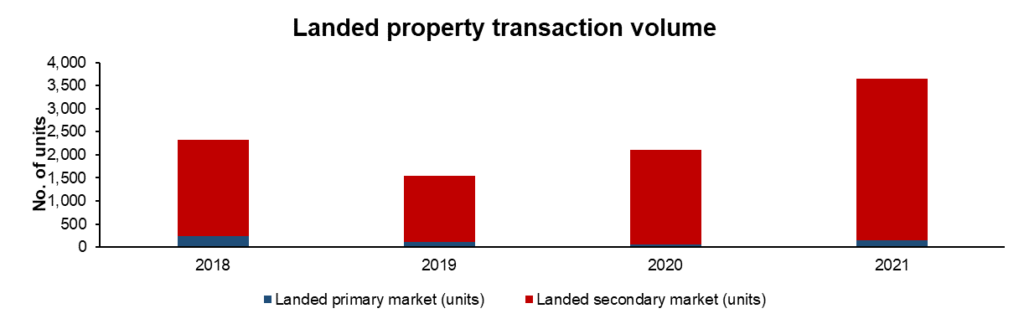

Some 2,113 landed homes were reportedly sold in 2020, compared to 1,545 units transacted in 2019, a 36.8% jump. In 2021, landed property transaction volumes jumped a further 73.1% to 3,658 units, in line with the overall recovery in the residential property market.

Figure 1: Landed property transaction volume

Source: URA, ERA Research & Consultancy

Due to the limited supply of landed housing in the primary market, the sales of more than 90% of landed homes were transacted in the secondary market. Still, both primary and secondary markets saw increases in the number of units sold in 2021 — primary sales volumes rose by 142% year on year while secondary sales volumes increased by 71.1% year on year.

Among the three market segments in Singapore, the Core Central Region saw the highest increase in landed home transaction volumes in 2021, followed by the Rest of the Central Region and Outside Central Region, respectively. The growing transactions in the prime areas underpinned the growing appetite among landed housing buyers who can afford more expensive homes in prime locations.

Table 2: Landed property transaction volume by market segments

| Year | Core Central Region | Rest of Central Region | Outside Central Region |

|---|---|---|---|

| 2020 | 291 | 346 | 1,476 |

| 2021 | 574 | 664 | 2,420 |

| Increase year-on-year | 97.3% | 91.9% | 64.0% |

Source: URA, ERA Research & Consultancy

Rental demand remained strong

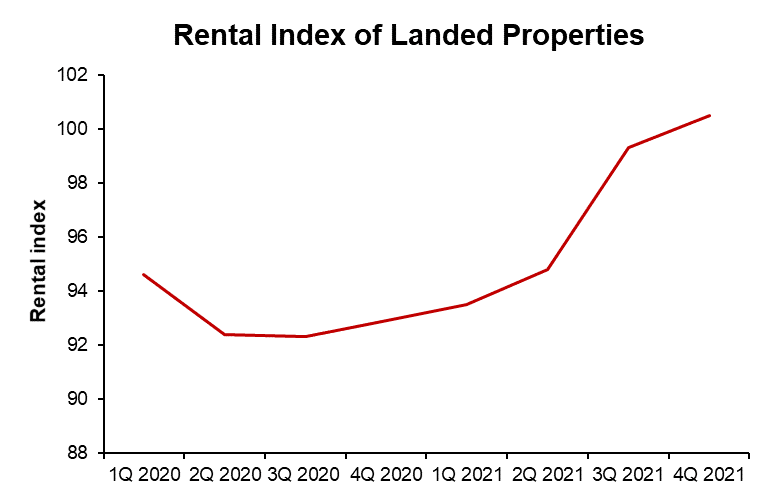

Meanwhile, movements in landed property rental rates in Singapore were more closely correlated to the economic climate and the job market. The landed rental index contracted from 1Q 2020 to 3Q 2020 when border restrictions were tightened and expatriate tenants left Singapore.

When the vaccination programme was announced towards the end of 2020, market sentiment improved as people expected the economy to recover and the borders to reopen in the near future. As a result, the landed housing rental index started to rise from 4Q 2020 and into 2021. By the end of 2021, rental rates of landed homes had increased by 8.2% year-on-year, compared to the 2.7% contraction in 2020.

Figure 2: Landed property rental index

Source: URA, ERA Research & Consultancy

Residential leasing demand from local residents also contributed to the rise in landed housing rental rates. With the completion of new residential developments being delayed due to supply-chain bottlenecks, some homebuyers had to temporarily rent their accommodation while waiting for their new homes to be completed. The demand for rental landed homes was also boosted by the demand for more space due to the widespread work-from-home practice.

Looking ahead: Impact of cooling measures

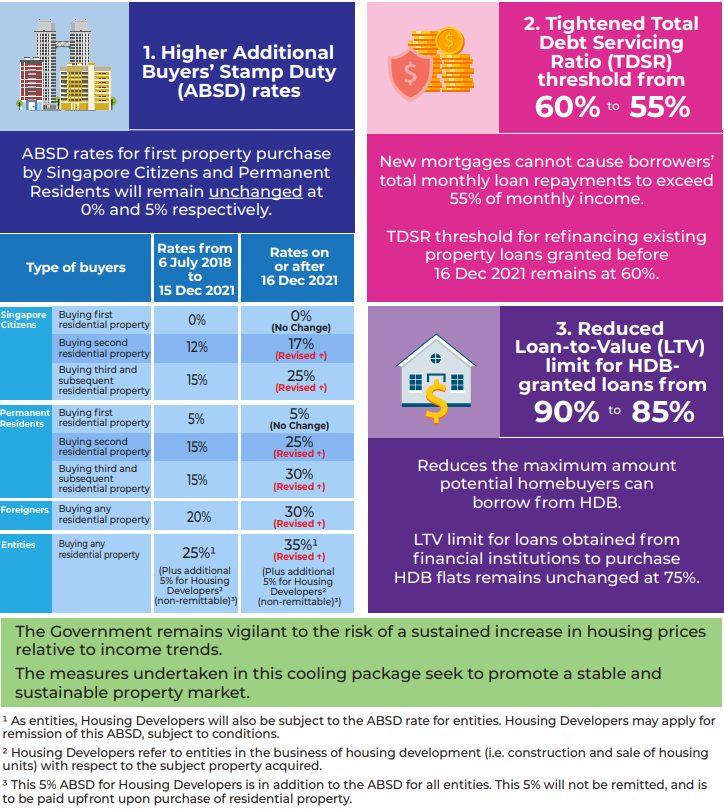

In the wake of the strong price gains and exuberance in the residential property market, the Singapore government introduced a new round of property market cooling measures on 15 December 2021. The new market curbs include raising the Additional Buyers’ Stamp Duty (ABSD) rates and tightening the Total Debt Servicing Ratio (TDSR) threshold from 60% to 55%.

Figure 3: New market curbs from 16 December 2021

Source: Ministry of National Development

Property sales could soon slow down as both buyers and sellers adopt a wait-and-see approach. However, as most of the buyers of landed homes are Singaporeans, who are exempted from paying ABSD if they are buying their sole residential property, the landed housing market could be less affected by the government’s new measures in the longer term.

Higher property taxes

Furthermore, in Singapore Budget 2022, the government said that it will increase the property tax rate for owner-occupied residential properties in two stages — from 4% to 16% currently, to 6% to 32% by 2024. The property tax rate for non-owner-occupied residential properties will be raised from the current 10% to 20%, to 12% to 36% in 2024.

Although the increase in the tax rate appears to be rather large in absolute terms, it is not expected to have a significant negative impact on demand for landed homes. This is because landed homes in Singapore are typically owned by wealthy individuals who could likely afford to absorb the increase in property taxes. Moreover, the incremental amount of property tax may not be particularly significant if capital values of landed property continue to expand in the long term.

We at Precepts Group also provide Associate Estate Planning Practitioner (AEPP) Certification Programme.

The above article appeared on EPPL’s The Custodian, Issue 21.

#Wills #Estate Planning

Nicholas Mak