The use of trust for legacy and succession planning has its significant merits but there are some limitations. The use of trusts for legacy and succession planning has significant merits but there are some limitations where it concerns the person of the trustees. This is where we introduce the concept of a PTC (private trust company). It is suitable for families with substantial family business assets and other family properties. These families face unique challenges as their family generations expand over time.

In the typical TV dramas and many real-life cases, such family businesses lose their direction and control over time and the family and the assets inevitably split up. The development of an estate plan and use of a succession tool like PTC can overcome such challenges. Such a structure has been utilized across modern jurisdictions with much success to help preserve the family wealth.

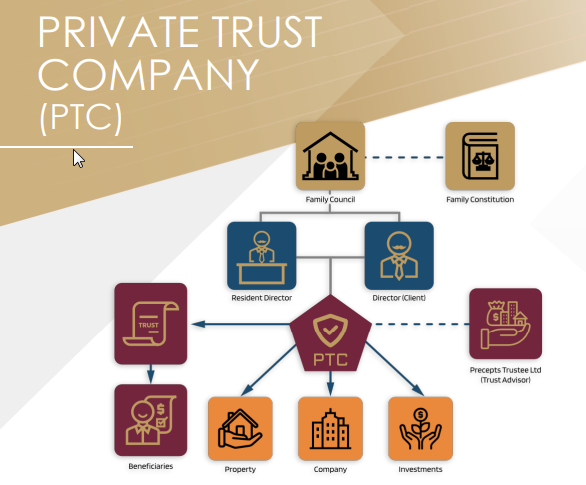

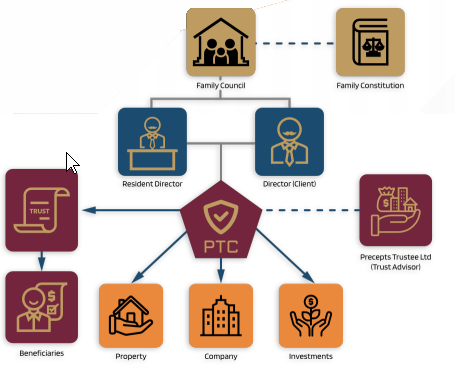

PTCs are established with the sole purpose of acting as a corporate trustee to a family trust or a number of family trusts, where the settlor and beneficiaries are connected persons.

PTCs are commonly used by high net worth (HNW) families in their wealth structuring. When it comes to family companies, the PTC offers aspects that may be absent in the traditional trust. Whereas the traditional trust structure requires the settlor to give up ownership over certain assets to someone else, in the PTC, the settlor will be more comfortable shifting his assets into a special purpose vehicle which provides for his family members.

The PTC offers a structure where the founder could make the transfer and consolidate the ownership of his diversified family businesses, investments and real estate into one vehicle which also is the trustee. The assets as a result do not get diluted by family growth or marital complications. The structure reduces the chance that these assets become a source of envy, greed and infighting.

With proper structuring, the PTC can be a suitable trustee for a family trust to address concerns such as:

- Succession of wealth for the family

- Asset protection and avoiding adverse claims e.g. business creditors, divorce and family feuds.

- Wealth preservation and investment

FEATURES OF A PRIVATE TRUST COMPANY STRUCTURE:

Other than the family trust instrument, there is usually a family constitution. The family constitution provides

- the governance framework,

- the rules governing the relationships and roles of the family members in the family council,

- the appointment of various committees to carry out certain roles,

- the policies for distribution of the family wealth through the family trusts,

- the human resource policies and compensation of family members employed by the family companies etc.

The family constitution typically stipulates the establishment of a family council and its functions as the supervisory body of the board of directors of the PTC. The family council also provides the communication channel and forum for all the family members to participate in the affairs of the family.

As significant wealth continues to grow in the family, the family PTC could also in time eventually be structured as part of a family office.

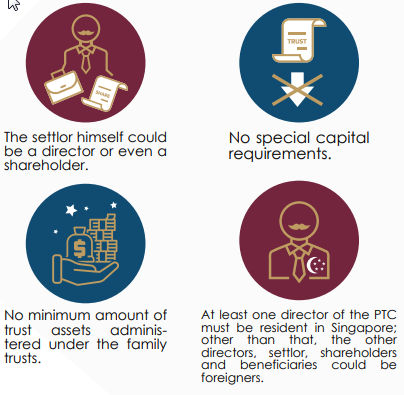

Notably, under the Trust Companies (Exemptions) Regulations 2005, the PTC is specifically defined and mentioned as an exempt entity; i.e. it is not required to seek a Trust Business License under the Licensing regime for Trust Companies. At Precepts Trustee Ltd, we assist families to set up their PTCs, and subsequently provide the support to maintain the PTC to comply with regulatory obligations and requirements as well as to provide advice for legacy planning.

Make an appointment with us to explore how the PTC structure can enable you to achieve your legacy plans.