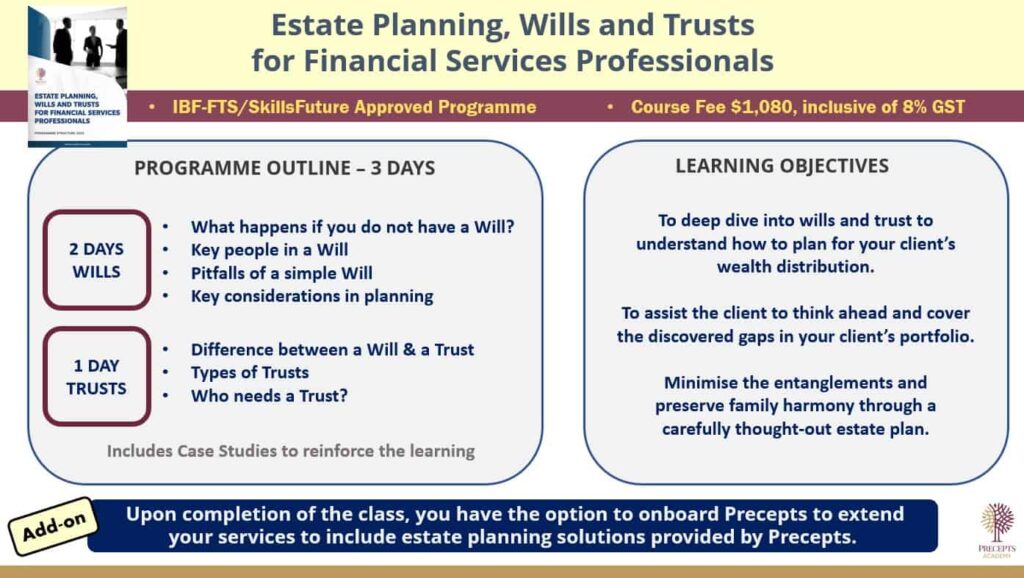

Estate Planning, Wills And Trusts For Financial Services Professional

Programme Structure

This is structured to kickstart your knowledge in Estate Planning. The trainers are senior and qualified practitioners who are experienced and passionate in Estate Planning.

Course Dates and Registration

Courses | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|

Associate Estate Planning Practitioner (AEPP®) Certification Programme | 2,3 Tu/We | 7,8 Tu/We | 5,6 We/Th | 2,3 Tu/We | 1,2 Th/Fr & 29,30 Th/Fri | - | 1-2 Tu/We | 5,6 Tu/We | 2,3 Mo/Tu |

Estate Planning, Wills and Trusts for Financial Services Professionals | 17-19 We-Fr | 13-15 Mo-We | 12-14 We-Fr | 15-17 Mon-Wed | 12-14 Mo-We | 11-13 We-Fr | 16-18 We-Fri | 18-20 Mo-We | 9-11 Mon-Wed |

2-day Onboarding | 25-26 Th/Fr | 23-24 Th/Fr | 19-20 We/Th | 24-25 We/Th | 22-23 Th/Fr | 25-26 We/Th | 23-24 We/Th | 27,-28 We/Th | 18-19 We/Th |

Advanced Module - Buy-Sell Arrangements for Business Owners | - | - | - | - | - | - | - | - | - |

Advanced Module - Estate Planning and Trusts relating to Real Estate | 9 Tu | - | - | - | - | - | - | - | - |

Advanced Module - Wealth Transfer of Real Estate for Financial Services Professionals | - | 16-17 Th/Fr | - | - | - | - | 10-11 Th/Fi | - | - |

Advanced Module - Wealth Succession for High Net Worth Clients | - | - | - | - | 5-6 Mo/Tu | - | - | - | - |

Advanced Module - Tax Planning in Wealth Management for Financial Services Professionals | - | - | - | - | - | - | - | - | - |

Advanced Module - Charitable and Philanthropic planning for Wealth Advisers | - | - | - | - | - | - | - | - | - |

Objectives

To deep dive into the estate planning solutions provided by wills & trusts.

Objectives

We will equip you with practical and marketing-based knowledge by using estate planning solutions to enhance your professional services.

Learn how to leverage on the Precepts Platform to provide Estate Planning services and enable you to provide a total wealth planning solution to your client.

Part 1: Estate Planning, Wills And Trusts For Financial Services Professional 3-Day Course Outline

Day 1

- Introduction to Estate Planning

- Overview of Estate Planning

- Intestate Succession Act

- Appointment of Administrator

- Application of Letter of Administration

- Circumstances where sureties are required

- Revocation of a Will

- Wills Consideration

- About the Testator

- Location of Assets & Attestation

- The duties of the Executor & Trustee

- Introduction to Estate Administration

- Grant of Probate vs Letter of Administration

- Guardian of Minor Children

- Beneficiaries

- Types of Specific Gifts – Movable & Immovable

- Insurance Nominations

- CPF Nomination

- Residuary Estate

- Testamentary Trust

- Digital Assets

Day 2

- Singapore Real Estate

- Dealing with Cross-Border Assets

- Risk Management Aspects of Will Writing

- Will Custody Services

- Case Studies

Day 3

- Introduction to Trust

- Differences between Will & Trust

- Parties to a Trust

- Categories of Trusts

- Purposes of creating a Trust

- Ways in using the Trust

- Applications of Life Insurance Trust

- Lasting Power of Attorney

- Some Planning Considerations

- Introducing, Facilitating and Creating Trusts

- Regulations of Trust Companies

- Quick look at Muslims

- Quick look at Persons with Special Needs

Part 2: Precepts Platform

1. Kickstart Programme through an Estate Planning Course

- Part 1

- Wills Training – 2 days

- Trust Training – 1 day

- Part 2

- Onboarding Precepts + Exam – 2 days

2. Kickstarter Kit

- Precepts Name Card

- Precepts Email

- Training Booklets

- Brochures

- Access to our Presentation Slide Decks

- Access to a Library of Resources and past talks/sharing sessions

3. Exclusive Discounts

- Discount on your own & spouse’s Will & Trust

4. Additional 3 income streams for services finalised

- Immediate

- Recurring

- Deferred

5. Direct access to Precepts’ Products & Services to extend your range of services

- Consultation for Will writing

- Safe keeping of Will in a secured facility

- Trust Set up

- Professional Executor

- Licensed Trust Company with MAS for Trusteeship

- Lasting Power of Attorney Form 1 & 2

- Setting up of Singapore & offshore companies

6. Continuous training and support from Precepts

- Learn to use our online proprietary will writing system to key in the client’s instructions for drafting

- Attend our Monthly Sales Booster Class

- Invite your clients to our Monthly Estate Planning Talk

- Attend our Essential Sharing Sessions throughout the year on relevant Estate Planning Topics

- Re-attend our Estate Planning Course as a refresher

*These are provided mostly on a complimentary and sign-up basis.

Course Dates

3 Days Schedule: Estate Planning, Wills and Trusts for Financial Services Professionals

IBF-FTS / SkillsFuture Course (18 hours)

Objectives:

- Gain knowledge by deep diving into Estate Planning concepts and solutions

- Learn about Wealth Distribution strategies

Time & Location:

- 9 am to 5pm

- Precepts Office #06-17 International Plaza

Month | Course Dates |

|---|---|

Apr 2024 | 17, 18, 19 (Wed - Fri) |

May 2024 | 13, 14, 15 (Mon - Wed) |

Jun 2024 | 12, 13, 14 (Wed - Fri) |

Jul 2024 | 15, 16, 17 (Mon-Wed) |

Aug 2024 | 12, 13, 14 (Mon - Wed) |

Sep 2024 | 11, 12, 13 (Wed - Fri) |

Oct 2024 | 16, 17, 18 (Wed - Fri) |

Nov 2024 | 18, 19, 20 (Mon - Wed) |

Dec 2024 | 9, 10, 11 (Mon - Wed) |

Testimonials

AEPP® Certification Programme

The Associate Estate Planning Practitioner (AEPP® ) designation certification programme is a 2-day marketing-based course for professional financial advisers to enable them to offer estate and succession planning advice to enhance their core services. Since 2009, this programme addresses the growing needs of the mass affluent for a comprehensive discussion on estate and succession planning in Asia. It has to date benefited more than 4000 practitioners in Asia within the banking and financial planning industry as they are now equipped with knowledge of another topic that expands their advisory scope.

Upon completion and passing of an examination, participants will be able to add the AEPP® designation to their professional qualification title/ credentials. The accreditation of The Associate Estate Planning Practitioner (AEPP® ) is awarded by the Society of Will Writers of the United Kingdom and the Estate Planning Practitioners Limited (EPPL).

AEPP® Advanced Modules

In Singapore, participants of the AEPP® programme can tap on the Financial Training Scheme (FTS), known as IBF-FTS funding to subsidise their training fee and also clock in their mandatory Continuing Professional Development (CPD) hours.

- Receiving high-value practical knowledge that can be applied to their current practice immediately and stay ahead of their competitors.

- Gaining access to the expertise of practitioners of estate planning who are able to relate real-life case studies and their applications.

- Having the ability to apply the practical concepts taught in this programme.

2024 Calendar

Courses | Course Duration | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|

Associate Estate Planning Practitioner (AEPP®) Certification Programme | 2 Days Day 1: 9am - 6pm Day 2: 9am - 6pm | 2,3 Tu/We | 7,8 Tu/We | 5,6 We/Th | 2,3 Tu/We | 1,2 Th/Fr & 29,30 Th/Fri | - | 1-2 Tu/We | 5,6 Tu/We | 2,3 Mo/Tu |

Advanced Module – Buy-Sell Arrangements for Business Owners | 1 Day: 9am - 6pm | - | - | - | - | - | - | - | - | - |

Advanced Module – Estate Planning and Trusts relating to Real Estate | 1 Day: 9am - 5pm | 9 Tu | - | - | - | - | - | - | - | - |

Advanced Module – Wealth Transfer of Real Estate for Financial Services Professionals | 2 Days Day 1: 9am - 5pm Day 2: 9am - 4.30pm | - | 16, 17 Th/Fr | - | - | - | - | 10,11 Th/Fi | - | - |

Advanced Module – Wealth Succession for High Net Worth Clients | 2 Days Day 1: 9am - 5pm Day 2: 9am - 4.30pm | - | - | - | - | 5,6 Mo/Tu | - | - | - | - |

Advanced Module – Tax Planning in Wealth Management for Financial Services Professionals | 1.5 Days Day 1: 9am - 5pm Day 2: 9am - 1pm | - | - | - | - | - | - | - | - | - |

Advanced Module – Charitable and Philanthropic planning for Wealth Advisers | 2 Days Day 1: 9am – 5pm Day 2: 9am – 4pm CPD hours: 12 hours | - | - | - | - | - | - | - | - | - |